You’ve booked your flights. Your ski passes are locked in.

The powder is calling!

But what happens if a fall ends your trip on day one?

Every year, more than 600,000 people are injured on ski and snowboard slopes. Whether it’s a broken collarbone or a freak snowstorm that shuts down the resort, things don’t always go as planned — and regular travel insurance rarely covers snow sports by default.

That’s where ski travel insurance comes in. It’s designed specifically to protect skiers and snowboarders from the risks of winter travel — injuries, gear damage, trip delays, and more.

Quick note: We do our best to ensure everything in this article is accurate and up to date, but coverage details can change. Always check the latest policy documents directly with the insurance provider before purchasing.

What Is Ski Travel Insurance?

Ski travel insurance covers the unique risks skiing and snowboarding that standard travel insurance often excludes.

Most ski travel insurance policies typically include the following benefits:

- Emergency medical expenses

- Evacuation and repatriation if you’re injured

- Trip cancellation or weather-related disruption

- Lost or damaged ski and snowboard gear

- Lift pass or ski school reimbursement if you can’t use them

- Piste or resort closure due to weather

Advanced policies may also cover off-piste, heli-skiing, cat-skiing, and backcountry touring — sometimes with a guide requirement.

Ski travel insurance is essential for any ski vacation.

The 7 Best Ski Travel Insurance Providers in 2025

Whether you’re a first-timer heading to Niseko or a veteran chasing powder in the Alps, here are seven ski travel insurance plans to consider for your next ski vacation.

1) World Nomads – Best for Adventure Travelers

World Nomads is a favorite among long-term travelers and digital nomads. Their coverage is flexible, adventure-friendly, and can even be purchased after your trip begins.

Why it’s great:

- Covers skiing, snowboarding, terrain parks, and touring

- Heli-skiing and off-piste covered (with Winter Sports add-on)

- Designed for backpackers and solo travelers

- Coverage available even if you’re already overseas

2) Rise & Shield – Best for Thrill Seekers and Multi-Trip Coverage

Built by adventurers for adventurers, Rise & Shield is newer on the scene but quickly becoming a top pick for adrenaline-filled travel. They offer protection for over 150 high-risk activities.

Why it’s great:

- Covers ski touring, heli-skiing, and backcountry adventures

- Ideal for solo travelers, families, and long-season skiers

- Single and annual multi-trip options available

- 24/7 emergency support, underwritten by Lloyds

Fast Cover – Ski Insurance3) Fast Cover – Best for Aussies and Families

Fast Cover is one of the most comprehensive options available for Australian travelers — with strong protection whether you’re skiing in Japan, Europe, or at home.

Why it’s great:

- Off-piste, cat skiing, and heli-skiing covered (with licensed guide)

- Includes rental gear replacement, lift pass reimbursement, and resort closure

- Medical evacuation included

- Covers travelers up to 69 years of age

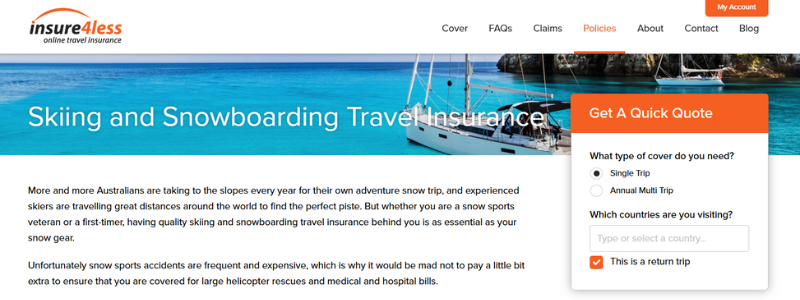

4) Insure4Less – Best for Backcountry & Touring

If you’re venturing into the backcountry or planning a guided ski tour, Insure4Less offers some of the broadest snow sports coverage — with fewer restrictions than many competitors.

Why it’s great:

- Includes ski touring, glacier skiing, Randonnée, and snowcat access

- Search and rescue covered under the Excel Plus plan

- Off-piste covered with appropriate policy selection

- Some limitations apply for North American travel

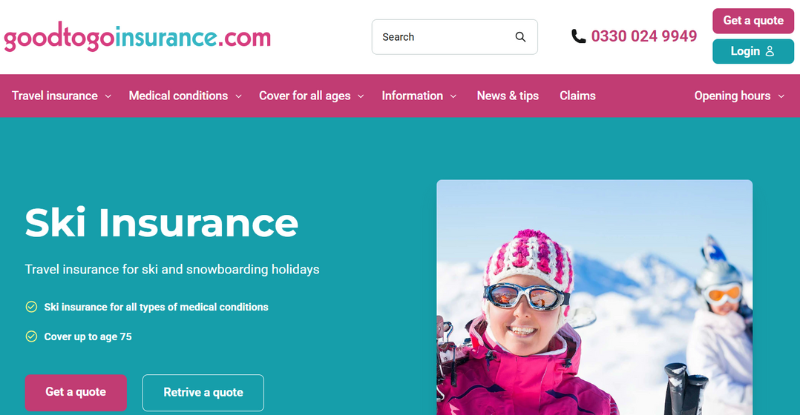

https://eventshakuba.com/recommends/good-to-go-insurance/5) Good to Go Insurance – Best for Pre-Existing Conditions

Good to Go specializes in travel insurance for older adults and those with health conditions. Their ski plans are available up to age 75 and include options for even serious pre-existing conditions.

Why it’s great:

- Covers conditions like heart disease, cancer, and diabetes

- £10M in emergency medical bills and repatriation cover

- Lift pass and gear reimbursement included

- Upgrade options available (e.g., volcanic ash, insolvency, etc.)

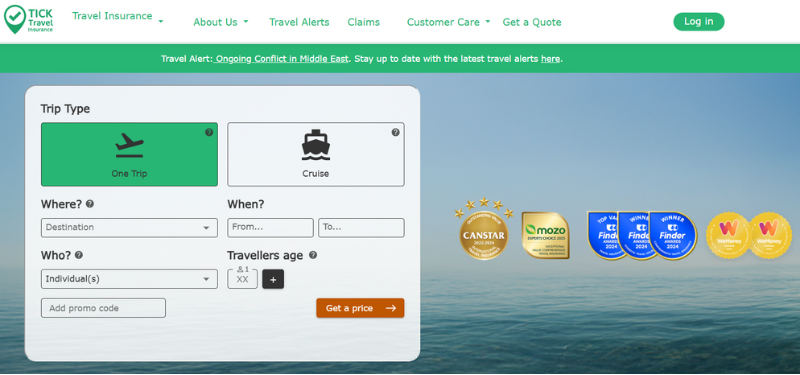

6) Tick Travel Insurance – Best Budget Option

If you’re looking for solid coverage without blowing your budget, Tick Travel Insurance offers excellent value with optional winter sports coverage.

Why it’s great:

- Backcountry and heli-skiing covered (with licensed guide)

- Clear guidelines on what’s included and excluded

- Good for younger travelers and short trips

- Competitive pricing without sacrificing key protections

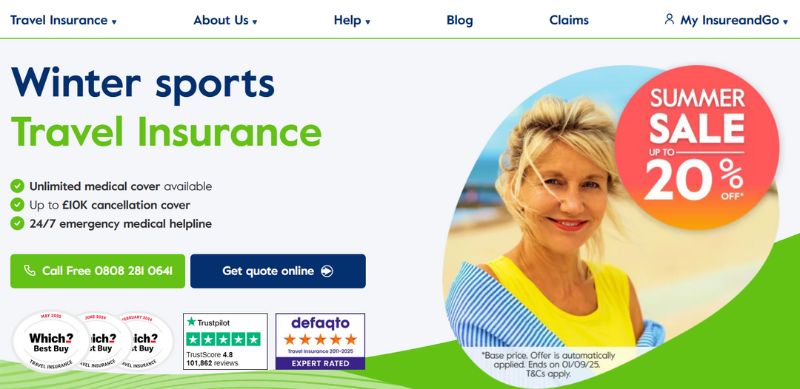

7) Insure and Go – Easiest to Understand

Insure and Go is perfect if you’re booking ski insurance for the first time and don’t want to get lost in the fine print. Their winter sports add-on is simple and clear.

Why it’s great:

- Includes freestyle, off-piste (unless marked unsafe), and ski touring

- Covers heli-skiing and cat-skiing with a guide

- Straightforward policy language

- Available for travelers up to age 65

Ski Insurance Comparison Table

| Company | Off-Piste | Backcountry | Heli/Cat | Pre-Existing Medical | Age Limit | Benefit Limit |

|---|---|---|---|---|---|---|

| World Nomads | ✔ (with guide) | ✔ | ✔ | Moderate | 70 | Unlimited |

| Rise & Shield | ✔ | ✔ | ✔ | Varies | 70 | High |

| Fast Cover | ✔ (with guide) | ✔ | ✔ | Yes | 69 | Unlimited |

| Insure4Less | ✔ | ✔ | ✔ | Limited Info | ~70 | High |

| Good to Go | ✔ | ✔ | ✔ | Excellent | 75 | £10M |

| Tick Travel | ✔ (with guide) | ✔ | ✔ | Moderate | 70 | High |

| Insure and Go | ✔ | ✔ | ✔ | Yes | 65 | Good |

Coverage varies by policy type and location. Always confirm with the insurer before booking.

What Does Ski/Snowboard Travel Insurance Typically Cover?

A good ski insurance policy usually includes:

- Emergency medical treatment and air ambulance

- Cancellations or trip interruptions

- Weather-related delays or ski resort closures

- Lost, damaged, or stolen ski/snowboard gear

- Lift pass reimbursement

- Gear rental coverage

More advanced plans may also cover:

- Heli/cat skiing (with guide)

- Backcountry touring (with guide)

- Free-style terrain park access

How to Choose the Right Ski Insurance

Here’s what to consider:

- Where you’re skiing: Some insurers limit coverage in the US or Canada due to high costs.

- What you plan to do: Are you sticking to groomers or heading into the backcountry?

- How often you ski: One trip or all winter long?

- Medical needs: Do you have pre-existing medical conditions or age restrictions to consider?

- Value vs. price: Don’t just go for the cheapest plan — look at what’s covered.

Final Thoughts

Ski travel insurance is like a helmet — you hope you never need it, but you’ll be glad you had it when things go wrong.

Whether you’re planning a week in Hakuba, a backcountry tour in Europe, or a family trip to Whistler, don’t leave your trip to chance. A small investment now can save thousands later.

Reminder: We’ve done our best to make this guide helpful and accurate, but insurance policies can change. Be sure to check the latest policy details with the provider before you book.

FAQs

Does ski insurance cover lift passes?

Yes — most will reimburse unused lift passes if you’re injured or your trip is cut short.

What about heli-skiing or terrain parks?

Some plans include them automatically, others require an add-on or guide. Always double-check.

Will my gear be covered?

Most plans include protection for ski and snowboard gear. Coverage limits vary, and you may need proof of value.

Can I get coverage if I have a health condition?

Yes — several providers specialize in this, especially Good to Go and Insure and Go.

Is off-piste covered?

Often yes — but usually only with a licensed guide. Definitions vary, so check the PDS or policy documents carefully.

Hi, welcome to Events Hakuba. I started this site about eight years ago with a friend (who’s since moved away) to help travelers get more out of their time in Hakuba. What began as an event calendar has grown into a resource for everything from logistics to local insights.

It’s a one-person operation, and while I do my best to keep things current, it’s not a full-time gig—so thanks for your patience if anything’s slightly out of date.

If you’re curious about my main work, I run The Fifth Business — helping independent hotels scale guest revenue, retention, and operations without adding complexity.

2 Comments