Don’t let your Japanese adventure turn into a disaster.

I’ve seen it happen countless times. Guests arrive excited to start their Japan trip, and something goes awry. Their bags get lost, they get sick or injured, or they encounter a natural disaster.

The next thing they know, I’m driving them to the hospital, and they are facing an outrageous bill that they hadn’t budgeted for. Their trip budget is blown, they are in a foreign country without insurance coverage, and their dream vacation becomes a nightmare.

Travel insurance can save the day. It provides coverage for unexpected events, expenses, and, most importantly, peace of mind. I highly recommend investing in travel insurance to protect yourself and your loved ones during your travels.

Here are some of the best Japan travel insurance options.

Best Japan Travel Insurance

Here are the best travel insurance plans tailored to different needs:

- Best Overall – World Nomads

- Best Budget Option – Safety Wing

- Best Comprehensive Coverage – Faye Travel Insurance

- Best For Families – Travelex

- Best For Flexibility – Allianz Travel Insurance

1 – Best Overall – World Nomads

We have recommended World Nomads to our readers and customers for years. They are our preferred Ski Travel Insurance provider. World Nomads offers comprehensive coverage at a reasonable price. Their policies cover medical expenses, trip cancellation or interruption, baggage loss or delay, and more. Additionally, World Nomads’ policies offer extensive travel insurance benefits, ensuring travelers are protected against a wide range of unexpected events.

World Nomads’ plans can include popular activities such as skiing and snowboarding. They have excellent customer service and an easy online claims process.

2 – Best Budget Option – SafetyWing

SafetyWing is an affordable option for budget travelers who want basic coverage during their trip to Japan. Their plans include medical expenses, emergency medical expenses, emergency medical evacuation, travel delays, etc.

One unique feature of SafetyWing is its continuous coverage for long-term travelers. This means you can purchase their insurance once and have coverage for up to 364 days, making it a convenient option for digital nomads or long-term travelers.

3 – Best Comprehensive Coverage – Faye Travel Insurance

Faye is noted for its comprehensive coverage and user-friendly plans. It offers extensive protection for medical emergencies, trip cancellations, and travel delays. The policy is highly rated and provides robust customer support. For travelers planning a trip to Japan, Faye offers tailor-made plans that cover activities like skiing and snowboarding. Faye’s travel medical insurance plans are designed to provide extensive protection for medical emergencies, ensuring travelers receive the care they need without financial worry.

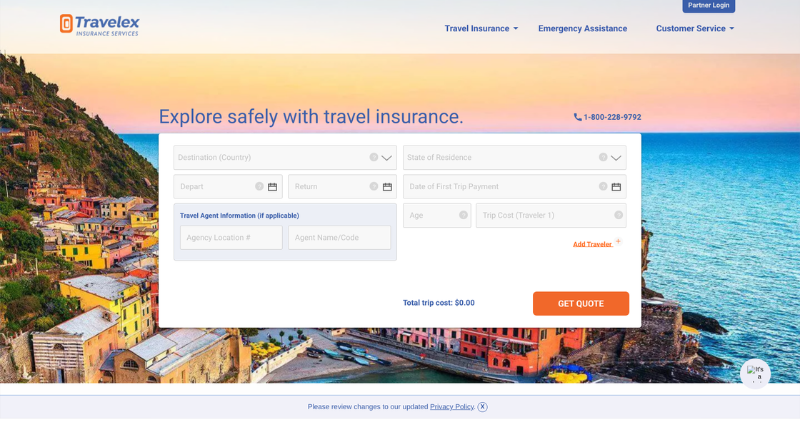

4 – Best For Families – Travelex

Travelex is popular among North Americans and offers customizable plans. Their Travel Select plan includes coverage for children 17 and under at no additional cost, making it ideal for families. It also provides comprehensive trip cancellation insurance and coverage for medical emergencies, trip cancellations, and travel delays.

Travelex offers customizable plans that allow travelers to choose the level of coverage they need. This makes it an excellent option for those wanting to personalize their insurance policy based on their needs and budget.

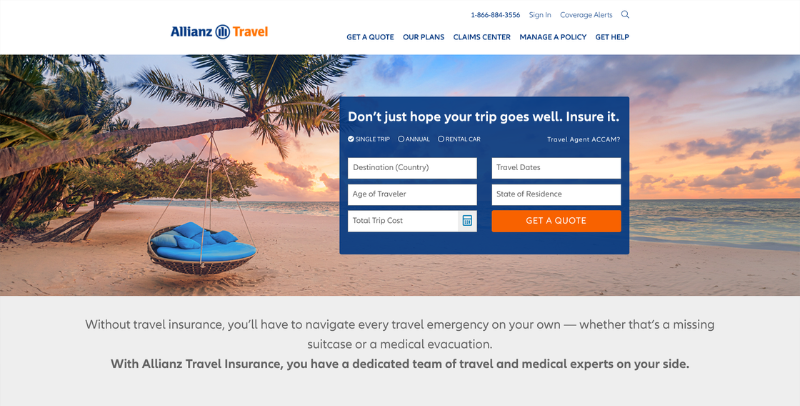

5 – Best for Flexibility – Allianz Travel Insurance

Allianz Travel Insurance is renowned for its flexible travel insurance coverage options, making it an excellent choice for travelers seeking tailored solutions. Their plans cover a variety of scenarios, including medical emergencies, trip cancellations, and lost luggage.

Allianz offers single-trip and annual plans, providing the flexibility to suit different travel habits. Additionally, their 24/7 assistance hotline ensures that support is always available, giving travelers peace of mind while exploring Japan. Whether you’re a casual tourist or a frequent traveler, Allianz can adapt to your specific needs.

Buying Guide for Travel Insurance

Navigating the sea of travel insurance options can be overwhelming. Here’s a brief guide to help you make an informed choice:

- Check Existing Coverage: Before purchasing, verify if your current health insurance or credit card offers travel insurance.

- Research and Compare: Use comparison tools to evaluate different providers and policies.

- Consider the travel insurance benefits provided by different providers, such as coverage for trip cancellations, medical emergencies, and lost luggage.

- High-Risk Activities: Ensure your policy covers any adventurous activities you plan to undertake.

- COVID-19 Coverage: Opt for policies that include coverage for COVID-19-related medical expenses.

- Policy Details: Scrutinize the fine print and understand exclusions, deductibles, and coverage limits.

- Ensure that the travel insurance coverage meets your travel needs, including protection against unexpected injuries and emergencies.

Common Travel Insurance Features

When selecting travel insurance, prioritize these features:

- Medical Coverage: Crucial for covering unexpected medical expenses and emergencies.

- Trip Cancellation and Interruption: This policy protects your investment if your trip is canceled or cut short, covering nonrefundable trip expenses.

- Travel Delays: Covers additional expenses incurred from delays.

- Baggage and Personal Effects: Offers compensation for lost or stolen belongings.

- Emergency Evacuation and Repatriation: Covers costs of emergency transport back home.

- Emergency Dental Expenses: This covers unexpected dental needs during your trip.

Other Coverage Options

Travel insurance companies often provide additional coverage for high-risk activities like adventure sports and rental car protection. Travelers can choose the coverage options that best suit their needs.

Travel Requirements for Japan

Travelers visiting Japan should thoroughly research and comply with all travel requirements. Key points to consider include:

- Visa Requirements: Check the Japanese government’s website for the latest visa information.

- Travel Documents: Ensure you have all necessary travel documents ready before departure.

- Insurance Options: Japan travel insurance can provide insights on travel requirements and coverage options.

For more details, visit the Japanese Government’s Travel Requirements.

Staying Safe in Japan

Japan is generally a safe destination, but travelers should still take precautions.

- Natural Disasters: Japan is prone to earthquakes, tsunamis, and typhoons. Familiarize yourself with emergency procedures and warning systems.

- Health Care: Although healthcare in Japan is excellent, foreign travelers may face challenges navigating the system or finding English-speaking medical staff.

Travelers should be aware of their surroundings and keep valuables secure. Japan travel insurance can provide financial protection for travelers in case of unexpected events. It may also cover emergency medical expenses, ensuring that travelers receive necessary medical care without financial worry.

Conclusion

A trip to Japan is a magical experience, but unexpected events can quickly turn it sour. Travel insurance ensures that your adventure remains a joyful memory rather than a financial nightmare. From comprehensive medical coverage to protection against trip cancellations, choosing the best insurance based on your unique needs will allow you to explore Japan confidently. So, plan your trip, purchase travel insurance, and embark on your Japan adventure worry-free.

FAQ

What kind of travel insurance do I need for Japan?

When traveling to Japan, choosing a travel insurance policy that provides comprehensive coverage tailored to your needs is advisable. Key features to consider include health insurance to cover medical emergencies, trip cancellation, interruption coverage in case unforeseen events arise, and personal belongings insurance to protect against loss or theft of your luggage and valuables. Additionally, coverage of natural disasters is essential in Japan, given the country’s susceptibility to earthquakes and typhoons. Ensure that your policy includes emergency evacuation and repatriation services, which can be critical in urgent situations. Before deciding, read the policy details carefully to understand the limits and exclusions.

Is travel insurance worth it for Japan?

Yes, travel insurance is worth it for Japan. While the country is known for its safety and hospitality, unexpected events can happen anytime during a trip. Travel insurance provides peace of mind and financial protection from falling ill or injured, losing your luggage, or canceling your flight.

How much does Japan travel insurance cost?

The cost of travel insurance in Japan varies depending on several factors, such as the length of your trip, your age, and the level of coverage you choose. On average, a comprehensive travel insurance plan for a 10-day trip to Japan can cost between $50 and $100. However, prices may vary based on the insurer and specific policy details. It is essential to compare quotes from different insurance providers to find a plan that offers adequate coverage at a competitive price.

How do I purchase travel insurance for Japan?

Travel insurance for Japan can be purchased online from various insurance companies or through a travel agency. Before making a decision, it is recommended to research and compare policies from different insurers to find one that best suits your needs and budget. Some popular international insurers that offer travel insurance for Japan include Allianz, AIG, and World Nomads. It is also advisable to read the policy details carefully and understand what is covered and excluded before purchasing.

What should I look for in a travel insurance plan for Japan?

When choosing a travel insurance plan for Japan, it is essential to consider particular factors such as:

- Medical coverage: As mentioned earlier, healthcare costs in Japan can be expensive, so ensure that your insurance plan includes adequate medical coverage.

- Trip cancellation/interruption coverage: This will provide reimbursement if your trip gets canceled or interrupted due to unforeseen events such as natural disasters or personal emergencies.

- Lost luggage coverage: This will protect you financially if your luggage gets lost or stolen during your trip.

- 24/7 emergency assistance: Look for a plan offering round-the-clock emergency assistance and support, especially if traveling solo.

- Adventure activities coverage: If you plan on participating in adventure sports such as skiing or hiking, ensure your insurance covers these activities.

Hi, welcome to Events Hakuba. I started this site about eight years ago with a friend (who’s since moved away) to help travelers get more out of their time in Hakuba. What began as an event calendar has grown into a resource for everything from logistics to local insights.

It’s a one-person operation, and while I do my best to keep things current, it’s not a full-time gig—so thanks for your patience if anything’s slightly out of date.

If you’re curious about my main work, I run The Fifth Business — helping independent hotels scale guest revenue, retention, and operations without adding complexity.